MOBILE PHONES AND TABLETS

ALL RISKS INSURANCE FOR FINANCING ACTIVITIES

F4 These terms replace previous terms AF4091, AFLT071 and AT05051

The insurance terms relate to mobile IT (e.g. mobile phones, tablets, vehicle mounted IT-equipment)

2014-01-01

These insurance terms are written in English. If there are differences between the English

1. Insured equipment

The insurance covers equipment specified in the rental, purchase and leasing agreement (”Financing Agreement”).

2. Who the insurance applies to

The insurance applies to TeliaSonera Finance AB, corporate identity number 556404-6661, 123 86 Farsta, Sweden and branches (”the Policyholder”), which in its capacity as financier and owner or possessor of ownership rights or right of repossession entered into the insurance agreement with the insurer regarding equipment listed in or covered by the specified Financing Agreement.

3. When the insurance applies

The insurance takes effect from the date when the equipment was delivered, although never later than the time when the Policyholder assumes liability responsibility for the equipment. The insurance ceases to be valid when the agreement period specified in the Financing Agreement expires.

4. Where the insurance applies

The insurance applies in the whole world.

5. What the insurance covers

The insurance covers physical damage to or loss of insured equipment by sudden and unforeseen event which has the effect that the equipment’s value is reduced or lost.

If the Financing Agreement includes theft-prone devices, such as, personal computers or video conference equipment, the insurance covers theft and damage in connection with burglary provided that the equipment is kept in locked premises with limited access.

6. General exceptions

Except for what is specified in paragraph 5 above, the insurance does not compensate damage or loss for which the Policyholder received compensation through another policy taken out by the Policyholder, nor damage for which the supplier or other responsible party through contract, warranty or similar commitment was compensated.

7. Special exceptions

Compensation is not payable for:

- damage as a consequence of the product being used by someone else than the purchaser’s or renter’s or lessee’s staff

- accessories for the product such as SIM cards, wireless equipment, assembly equipment and consumable items such as batteries, etc.. In case of theft and loss compensation will be paid for SIM card and standard battery,

- software such as computer viruses,

- fault or neglect by the user,

- minor damage (scratches, etc.), not affecting the usability of the product or which can be eliminated through normal service or adjustment,

- travel- or transport cost and indirect damage,

- cost of maintenance, adjustment, modification, service or damage or loss caused by such measures,

- damage consisting of or as a consequence of wear, corrosions, coating, improper handling, incorrect installation or neglected maintenance. Improper handling and neglected maintenance means for example that the product’s user instructions are not followed,

- damage resulting from the processing, repair or maintenance and which can be compensated by other insurance,

- damage due to insured equipment being left unsupervised in vehicle, school premises, public premises or public places, unless the equipment was kept in separate locked room not visible from the outside, If the Financing Agreement includes vehicle equipment this must be permanently mounted in the vehicle to be covered by the insurance,

- cost for mounting and installation,

- damage through fraud, embezzlement or other crime against property,

- additional costs due to forced measures, e.g. repairs at overtime, purchase at higher prices for expedited delivery or transportation other than usual means of transport,

8. Excluded property

- Consumable supplies

- IT equipment intended for use in training activities

9. Safety precautions and duty of care

The equipment shall be handled and maintained in accordance with the manufacturer’s instructions, care and safety precautions as well as in general so that damage or loss is prevented as far as possible.

If guidelines, safety precautions and/or the requirement of duty of care are not complied with or if instructions, safety regulations and/or reasonable safety requirements are not complied with in relation to the equipment’s value and in the case of theft the risk of being stolen, compensation as a rule is reduced by a special deduction. In the case of serious neglect compensation will be substantially reduced and may even be completely withheld (reduction to zero).

In case of theft unrelated to burglary consideration will be made of what measures, especially security measures, were taken with respect to the equipment’s value and liability to be stolen.

10. Excess

Currency guidelines in this paragraph refer to the relevant country’s local currency.

With regard to units with a value in Norway and Sweden of less than NOK/SEK 2,000, the excess in Norway and Sweden is NOK/SEK 200. With regard to units with a value equal to or exceeding a value in Norway and Sweden of NOK/SEK 2,000, the excess in Norway and Sweden is NOK/SEK 1,000.

With regard to units with a value in Finland of

- less than EUR 200, the excess is EUR 20 in Finland.

- equal to or exceeding EUR 200 but less than EUR 300, the excess is EUR 30 in Finland.

- equal to or exceeding EUR 300, the excess is EUR 50 in Finland

The excesses apply irrespective of the cause of damage/loss.

11. Grounds for compensation

Compensation is only provided if the time, place and course of events can be specified and that reasonable safety measures are taken, in relation to the equipment’s value and liability to be stolen.

To the extent that the purchaser or renter or lessee is able to meet the conditions for compensation stipulated under this policy, the conditions apply equally to him and the Policyholder is responsible for ensuring that the purchaser, renter or lessee satisfies these conditions.

Currency guidelines in this paragraph refer to the relevant country’s local currency.

The sum insured is no more than the equipment’s acquisition value according to the Financing Agreement and never higher than in Norway and Sweden NOK/SEK 50,000 or EUR 5,000 in Finland per unit.

The maximum compensation per damage or loss in Norway and Sweden is NOK/SEK 1,000,000 or in Finland EUR 100,000.

In case of damage the equipment shall be repaired or, in case of total damaged, replaced.

The insurer reserves the right to determine whether the equipment shall be repaired or compensated with new or equivalent equipment. Equivalent equipment refers to equipment that has technical performance that as far as possible is equivalent to the damaged or lost equipment. Note that replacement may take place with reconditioned used equipment.

Cash compensation is not allowed for any loss or damage of equipment.

If the insurer in the case of damage replaces equipment or part thereof, the insurer claims ownership rights to the damaged equipment.

12. Measures in the event of damage/loss

Damage should be reported to AmTrust Nordic AB, or to another party that the insurer chose to engage for loss adjustment, see paragraph 14.

The notification of damage or loss shall be made without delay, however no later than – if the insurance is covered by Norwegian law – twelve (12) months or – if the insurance is covered by Swedish or Finnish law – six (6) months after the Policyholder became aware of the damage or loss.

As regards limitation, see paragraph 13.3.

If the equipment is stolen or in another way lost this must be reported to the police.

All documents that are of significance to the settlement of the claim should be attached to the claim form.

In the case of theft or loss of equipment the police report should be attached.

If the Policyholder in a fraudulent manner states, withholds or conceals anything of significance to the assessment of the claim, the insurance is not valid.

13. General terms of contract

13.1 Payment of premium

The premium is payable in advance. The insurer’s liability commences when the insurance period starts, even if the premium has not been paid. This however only applies provided that the premium is paid within 14 days after the insurer has sent the premium notification. In case of later payment the insurer is entitled to give notice of termination in accordance with the rules in the Insurance Contracts Act.

13.2 Force majeure

The insurer is not liable for loss directly or indirectly caused by or in connection with war, warlike event, civil war, military exercises, revolution, riot, terrorism, insurrection, atomic or nuclear weapon process, government action, confiscation, strike, lockout, blockade or similar event.

13.3 Limitation

Sweden

A person wishing to claim compensation loses his/her rights, if s/he does not file a lawsuit in court against the insurer within three years from when s/he became aware that the claim could be made and in any case within ten years from the earliest date on which a claim could have been made.

Finland

Claims for compensation based on the insurance agreement shall be directed to the insurer within one year after the claimant became aware of the insurance, claim and the consequential damage/loss brought about by the insured event. The claim for compensation shall in each case be made within ten years after the insured event. Submission of a claim for compensation equates to notification of the insured event. If any claim is not presented within the time currently specified the claimant loses his right thereto.

Norway

Claims for compensation become statute-barred after three years. The time limit starts to run at the expiry of the calendar year during which the insured became aware of the circumstances that justify the claim. The claim for compensation is limited to no later than 10 years after expiry of the calendar year during which the insurance event occurred.

13.4 Intended and foreseeable damage/loss

The insurer is not liable to the Policyholder for damage to any part that was damaged on purpose. The same also applies if the Policyholder must be presumed to have acted or failed to act in the knowledge that this meant a significant risk of the damage/loss occurring.

13.5 Gross negligence

If damage is caused by gross negligence the compensation that would otherwise be payable may be reduced to what is reasonable taking into account the circumstances.

13.6 Reclamation

To the extent that payment of insurance indemnity would not have taken place, the Policyholder is obliged to immediately pay back the amount to the insurer, even if the Policyholder had not been aware that the payment was erroneous.

13.7 Double insurance

If an interest insured in this policy is also covered by another policy and is in these terms in the event of double insurance, the same terms also apply in this policy.

13.8 Recourse

To the extent that the insurer has paid compensation the insurer assumes the Policyholder’s right to claim compensation from the person responsible for damage. If the policyholder after the damage has occurred waives his right to compensation from another or recourse, the insurer’s obligation to compensate is limited to the equivalent extent and the issued insurance compensation shall be paid back to the insurer.

13.9 Applicable law and jurisdiction

For the insurance agreement shall, if the Financing Agreement has been entered into via the Policyholder’s

- Finnish branch; Finnish law, Insurance Contract Act 28.6.1994/543 applies,

- Norwegian branch; Norwegian law, including the Insurance Contract Act of 16 June 1989 no. 69 applies,

- Swedish company; Swedish law, including the Insurance Contracts Act (2005:104) applies.

Disputes regarding the agreement shall be tried by a general court in

- Finland if the Financing Agreement was entered into via the Policyholder’s Finnish branch,

- Norway if the Financing Agreement was entered into via the Policyholder’s Norwegian branch,

- Sweden if the Financing Agreement was entered into via the Insured’s Swedish company. This also applies if the dispute refers to loss/damage that occurred abroad.

If the Policyuholder is not satisfied with the decision provided relating the loss/damage, the Policyholder can always have the decision reviewed by the insurer, by contacting AmTrust Nordic AB

The policyholder also has the opportunity to bring an action against the Insurer at a general court.

13.10 Personal Data Act

The insurer will process the Policyholder’s personal data in accordance with the Personal Data Act in the respective country. The purpose of the processing is the fulfilment of the contractual obligations towards the Policyholder. The personal data forms a further basis for marketing and client analysis, business and method development, statistics and risk management, marketing and service in general. The personal data may be processed by other companies that the insurer cooperates with for the performance of the assignment the insurer has from the Policyholder. If the Policyholder has any questions about this please do not hesitate to contact the insurer’s personal data representative at personuppgiftsombud@amtrustgroup.com. Under the personal data legislation the Insured is entitled to request information about and correction of the personal data that is processed. The Policyholder can therefore free of charge view the recorded information once a year. Such requests should be presented to the personal data representative at the address shown below and must be signed by the applicant. If the Policyholder wishes to request correction of incorrect personal data, please contact the personal data representative.

14. Insurer

The insurer for this insurance is AmTrust International Underwriters Ltd, 40 Westland Row, Dublin 2, Ireland. The insurer is represented in the Nordic countries by AmTrust Nordic AB.

Contact details of AmTrust Nordic AB: AmTrust Nordic AB, Grev Turegatan 14, 114 62 Stockholm, Phone +46 8 440 38 00

COMPUTERS AND OFFICE EQUIPMENT

ALL RISKS INSURANCE FOR FINANCING ACTIVITIES

F2 These terms replace previous terms AF2091 and AF04071

Insurance terms relating to PC and office equipment (e.g. printers, copiers, videoconference equipment, digital sign system, portable office telephony and headset for fixed and mobile telephony, fixed alarm and surveillance equipment)

2015-06-01

These insurance terms are written in English. If there are differences between the English version of the terms and the version in the local language, the English version shall prevail.

1. Insured equipment

The insurance covers equipment specified in the rental, purchase and leasing agreement (”Financing Agreement”).

2. Who the insurance applies to

The insurance applies to TeliaSonera Finance AB, corporate identity number 556404-6661, 123 86 Farsta, Sweden and branches (”the Policyholder”), which in its capacity as financier and owner or possessor of ownership rights or right of repossession entered into the insurance agreement with the insurer regarding equipment listed in or covered by the specified Financing Agreement.

3. When the insurance applies

The insurance takes effect from the date when the equipment was delivered, although never later than the time when the Insured assumes liability responsibility for the equipment. The insurance ceases to be valid when the agreement period specified in the Financing Agreement expires.

4. Where the insurance applies

The insurance applies all over the world.

5. What the insurance covers

The insurance covers physical damage to or loss of insured equipment by sudden and unforeseen exogenous event which has the effect that the equipment’s value is reduced or lost.

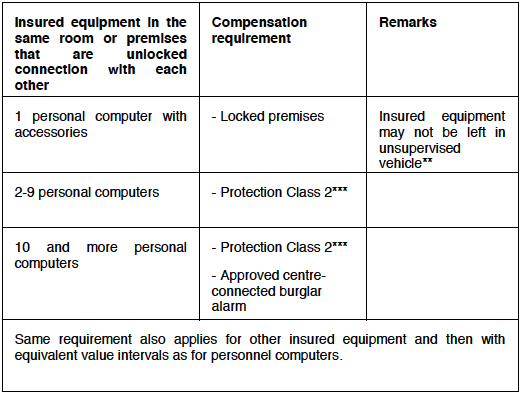

If the Financing Agreement includes theft-prone devices, such as, personal computers or video conference equipment, the insurance covers theft and damage in connection with burglary provided that the equipment is kept in locked premises with limited access in accordance with paragraph 9 below.

6. General exceptions

Except for what is specified in paragraph 5 above, the insurance does not compensate damage or loss for which the Policyholder received compensation through another policy taken out by the Policyholder, nor damage for which the supplier or other responsible party through contract, warranty or similar commitment was compensated.

7. Special exceptions

Compensation is not payable for:

- damage consisting of or resulting from a fault in the equipment arising from internal causes or deficiencies in design, material or manufacture,

- disruption in the supply of water,

- software such as computer viruses,

- fault or neglect by the user,

- consequential financial loss such as extra cost or loss that arising for example. by the equipment not being able to be used in the manner expected.

- damage through fraud, embezzlement or other crime against property,

- damage of such a nature that it does not affect the equipment’s usability or which can be repaired through normal service or adjustment,

- additional costs due to forced measures, e.g. repairs at overtime, purchase at higher prices for expedited delivery or transportation other than usual means of transport,

- cost of maintenance, adjustment, modification, service,

- damage consisting of or as a consequence of wear, corrosions, coating, improper handling, incorrect installation or neglected maintenance. Improper handling and neglected maintenance means for example that the product’s user instructions are not followed.

8. Excluded property

- Consumable supplies

- IT equipment intended for use in training activities

- Mobile terminals e.g. mobile telephones, tablets, PDAs and other similar equipment.

9. Safety precautions and duty of care

The equipment shall be handled and maintained in accordance with the manufacturer’s instructions, care and safety precautions as well as in general so that damage or loss is prevented as far as possible.

If guidelines, safety precautions and/or the requirement of duty of care are not complied with or if instructions, safety regulations and/or reasonable safety requirements are not complied with in relation to the equipment’s value and in the case of theft the risk of being stolen, compensation as a rule is reduced by a special deduction. In the case of serious neglect compensation will be substantially reduced and may even be completely withheld (reduction to zero).

In case of theft unrelated to burglary consideration will be made of what measures, especially security measures, were taken with respect to the equipment’s value and liability to be stolen.

Devices that are liable to be stolen, such as, personal computers or video conference equipment must be kept in locked premises as below.

** Locked vehicle approved however if the equipment is not visible outside and is fixed in the vehicle with locking device approved by the insurer.

***Protection Class means the usual rules that apply within the insurance and protection industry.

10. Excess

Currency guidelines in this paragraph refer to the relevant country’s local currency.

With regard to units with a value in Norway and Sweden of less than NOK/SEK 4,000 or in Finland EUR 400, the excess in Norway and Sweden is NOK/SEK 500 or EUR 50 in Finland.

With regard to units with a value equal to or exceeding a value in Norway and Sweden of NOK/SEK 4,000 or in Finland EUR 50, the excess in Norway and Sweden is NOK/SEK 1,000 or EUR 100 in Finland.

The excesses apply per damage/loss and irrespective of the cause of damage/loss.

11. Grounds for compensation

Compensation is only provided if the time, place and course of events can be specified and that reasonable safety measures are taken, in relation to the equipment’s value and liability to be stolen.

To the extent that the purchaser or renter or lessee is able to meet the conditions for compensation stipulated under this policy, the conditions apply equally to him and the Policyholder is responsible for ensuring that the purchaser, renter or lessee satisfies these conditions.

Currency guidelines in this paragraph refer to the relevant country’s local currency.

The sum insured is no more than the equipment’s acquisition value according to the Financing Agreement and never higher than in Norway and Sweden NOK/SEK 500,000 or EUR 50,000 in Finland per unit.

The maximum compensation per damage or loss in Norway and Sweden is NOK/SEK 20,000,000 or in Finland EUR 2,000,000.

In case of damage the equipment shall be repaired, or in case of being written off replaced.

The insurer reserves the right to determine whether the equipment shall be repaired or compensated with new or equivalent equipment. Equivalent equipment refers to equipment that has technical performance that as far as possible is equivalent to the damaged or lost equipment. Note that replacement may take place with reconditioned used equipment.

Cash compensation is not allowed for any loss or damage of equipment.

If the insurer in the case of damage replaces equipment or part thereof, the insurer claims ownership rights to the damaged equipment.

12. Measures in the event of damage/loss

Damage should be reported to AmTrust Nordic AB, or to another party that the insurer chose to engage for loss adjustment, see paragraph 14. The claims handling will be done in the country in which the financing agreement was concluded.

The notification of damage or loss shall be made without delay, however no later than – if the insurance is covered by Norwegian law – twelve (12) months or – if the insurance is covered by Swedish or Finnish law – six (6) months after the Insured became aware of the damage or loss.

As regards limitation, see paragraph 13.3.

If the equipment is stolen or in another way lost this must be reported to the police.

All documents that are of significance to the settlement of the claim should be attached to the claim form.

In the case of theft or loss of equipment the police report should be attached.

If the Policyholder in a fraudulent manner states, withholds or conceals anything of significance to the assessment of the claim, the insurance is not valid.

13. General terms of contract

13.1 Payment of premium

The premium is payable in advance. The insurer’s liability commences when the insurance period starts, even if the premium has not been paid. This however only applies provided that the premium is paid within 14 days after the insurer has sent the premium notification. In case of later payment the insurer is entitled to give notice of termination in accordance with the rules in the Insurance Contracts Act.

13.2 Force majeure

The insurer is not liable for loss directly or indirectly caused by or in connection with war, warlike event, civil war, military exercises, revolution, riot, terrorism, insurrection, atomic or nuclear weapon process, government action, confiscation, strike, lockout, blockade or similar event.

13.3 Limitation

Sweden

A person wishing to claim compensation loses his/her rights, if s/he does not file a lawsuit in court against the insurer within three years from when s/he became aware that the claim could be made and in any case within ten years from the earliest date on which a claim could have been made.

Finland

Claims for compensation based on the insurance agreement shall be directed to the insurer within one year after the claimant became aware of the insurance, claim and the consequential damage/loss brought about by the insured event. The claim for compensation shall in each case be made within ten years after the insured event. Submission of a claim for compensation equates to notification of the insured event. If any claim is not presented within the time currently specified the claimant loses his right thereto.

Norway

Claims for compensation become statute-barred after three years. The time limit starts to run at the expiry of the calendar year during which the insured became aware of the circumstances that justify the claim. The claim for compensation is limited to no later than 10 years after expiry of the calendar year during which the insurance event occurred.

13.4 Intended and foreseeable damage/loss

The insurer is not liable to the Policyholder for damage to any part that was damaged on purpose. The same also applies if the Policyholder must be presumed to have acted or failed to act in the knowledge that this meant a significant risk of the damage/loss occurring.

13.5 Gross negligence

If damage is caused by gross negligence the compensation that would otherwise be payable may be reduced to what is reasonable taking into account the circumstances.

13.6 Reclamation

To the extent that payment of insurance indemnity would not have taken place, the Policyholder is obliged to immediately pay back the amount to the insurer, even if s/he had not been aware that the payment was erroneous.

13.7 Double insurance

If an interest insured in this policy is also covered by another policy and is in these terms in the event of double insurance, the same terms also apply in this policy.

13.8 Recourse

To the extent that the insurer has paid compensation the insurer assumes the Policyholder’s right to claim compensation from the person responsible for damage. If the Policyholder after the damage has occurred waives his right to compensation from another or recourse, the insurer’s obligation to compensate is limited to the equivalent extent and the issued insurance compensation shall be paid back to the insurer.

13.9 Applicable law and jurisdiction

For the insurance agreement shall, if the Financing Agreement has been entered into via the Policyholder’s

- Finnish branch; Finnish law, Insurance Contract Act 28.6.1994/543 applies,

- Norwegian branch; Norwegian law, including the Insurance Contract Act of 16 June 1989 no. 69 applies,

- Swedish company; Swedish law, including the Insurance Contracts Act (2005:104) applies. Disputes regarding the agreement shall be tried by a general court in

- Finland if the Financing Agreement was entered into via the Policyholder’s Finnish branch,

- Norway if the Financing Agreement was entered into via the Policyholder’s Norwegian branch,

- Sweden if the Financing Agreement was entered into via the Policyholder’s Swedish company. This also applies if the dispute refers to loss/damage that occurred abroad.

If the Policyholder is not satisfied with the decision provided relating the loss/damage, the Policyholder can always have the decision reviewed by the insurer, by contacting AmTrust Nordic AB The Policyholder also has the opportunity to bring an action against the Insurer at a general court.

13.10 Personal Data Act

The insurer will process the Policyholder’s personal data in accordance with the Personal Data Act in the respective country. The purpose of the processing is the fulfilment of the contractual obligations towards the Policyholder. The personal data forms a further basis for marketing and client analysis, business and method development, statistics and risk management, marketing and service in general. The personal data may be processed by other companies that the insurer cooperates with for the performance of the assignment the insurer has from the Policyholder. If the Policyholder has any questions about this please do not hesitate to contact the insurer’s personal data representative at personuppgiftsombud@amtrustgroup.com. Under the personal data legislation the Policyholder is entitled to request information about and correction of the personal data that is processed. The Policyholder can therefore free of charge view the recorded information once a year. Such requests should be presented to the personal data representative at the address shown below and must be signed by the applicant. If the Policyholder wishes to request correction of incorrect personal data, please contact the personal data representative.

14. Insurer

The insurer for this insurance is AmTrust International Underwriters Ltd, 40 Westland Row, Dublin 2, Ireland. The insurer is represented in the Nordic countries by AmTrust Nordic AB.

Contact details of AmTrust Nordic AB: AmTrust Nordic AB, Hamngatan 11, 111 47 Stockholm, Phone +46 8 440 38 00